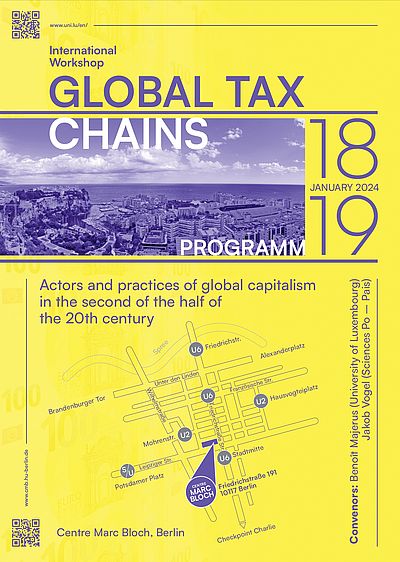

International Workshop: GLOBAL TAX CHAINS

18 janvier | 14h00

Actors and practices of global capitalism in the second of the half of the 20th century

As chains of wealth became global in the world economy (Seabroke&Wigan, 2022) so did tax strategies. These topics have gained increased attention in the last fifteen years as the crisis of 2007/2008 renewed the discussion on inequalities and (fiscal) justice. Humanities and Social Sciences played an important role in framing debates on this topic. Wealth was perhaps less produced by manufacturing cars or building houses than by moving capital across jurisdictions, creating multi jurisdictional spaces where national states, global companies, local financial plumbers and international organisations created, maintained and governed global tax chains. This workshop has a dual purpose. On the one hand, it intends to take stock of these ongoing international and interdisciplinary debates. On the other hand, it intends to deepen the historical dimensions to phenomena that are beginning to be well documented for today's world, but still sometimes lack temporal depth.

organised by Benoît Majerus and Jakob Vogel at Center Marc Bloch Berlin

Where? Friedrichstraße 191, 10117 Berlin

18.01. - Georg-Simmel-Saal, CMB. 3d floor

19.01. - room 5028, HU, 5th floor

Contact

Jakob Vogel

jakob.vogel ( at ) cmb.hu-berlin.de

Partenaires

Université du Luxembourg, C2DH (Luxembourg Center for Contemporany and Digital History), Luxembourg National Research Fund

Programme

Centre Marc Bloch, Berlin; 18 / 19 January 2024

Final program

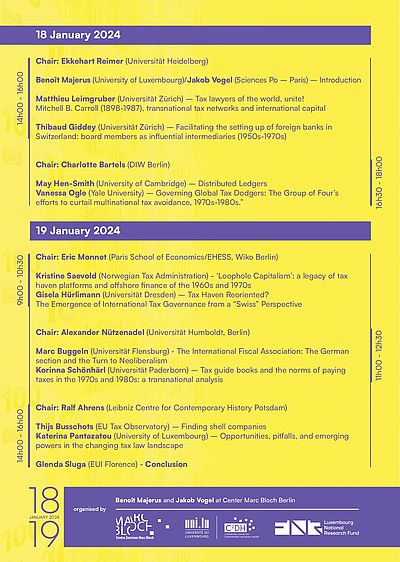

18 January 2024

Centre Marc Bloch, Fridrichstr. 191, Georg Simmel room (3rd floor)

13h-14h – Get-together with snacks at Center Marc Bloch

Begrüssung Jay Rowell (director CMB)

14h-16h – Chair: Lars Wieneke (Université Luxembourg)

Benoît Majerus (University of Luxembourg)/Jakob Vogel (Sciences Po – Paris) – Introduction

Matthieu Leimgruber (Universität Zürich) – Tax lawyers of the world, unite! Mitchell B. Carroll (1898-1987), transnational tax networks and international capital

Thibaud Giddey (Universität Zürich) – Facilitating the setting up of foreign banks in Switzerland:

board members as influential intermediaries (1950s-1970s)

16h30-17h30 – Chair: Charlotte Bartels (DIW Berlin)

May Hen-Smith (University of Cambridge) – Distributed Ledgers

19h15 – Dinner at restaurant – Sale e Tabacchi

19 January 2024

Humboldt University, Friedrichstr. 191 (5. Stock) room 5028

9h-10h30 – Chair: Eric Monnet (Paris School of Economics/EHESS, Wiko Berlin)

Kristine Saevold (Nowegian Tax Administration) - ‘Loophole Capitalism’: a legacy of tax haven platforms and offshore finance of the 1960s and 1970s

Gisela Huerlimann (Universität Dresden) – Tax Haven Reoriented? The Emergence of International Tax Governance from a “Swiss” Perspective

11h-12h30 – Chair: Alexander Nützenadel (Universität Humboldt, Berlin)

Marc Buggeln (Universität Flensburg), The International Fiscal Association: The German section and the Turn to Neoliberalism

Korinna Schönhärl (Universität Paderborn) – Tax guide books and the norms of paying taxes in the 1970s and 1980s: a transnational analysis

12h30-14h – Lunch at Institut für Geschichtswissenschaften – HU Berlin – Raum 5028

14h-16h – Chair: Ralf Ahrens (Leibniz Centre for Contemporary History Potsdam)

Thijs Busschots (EU Tax Observatory) – Finding shell companies

Katerina Pantazatou (University of Luxembourg) – Opportunities, pitfalls, and emerging powers in the changing tax law landscape

Glenda Sluga (EUI Florence) - Conclusion

Lieu

Georg-Simmel-SaalFriedrichstraße 191

10117

Berlin

Deutschland